Compound investment return calculator

For example the initial value of your investment is Rs 15000 and the final value is Rs 25000 in three years N 3 years. Enter the annual compound interest rate you expect to earn on the investment.

Investment Calculator

That amount is compounded quarterly for the number of quarters remaining before the end of the three-year period.

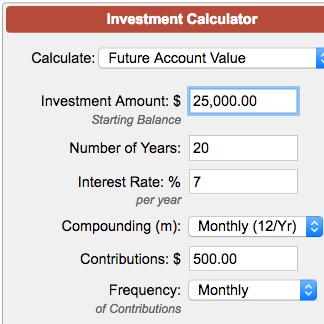

. If you start with 25000 in a savings account earning a 7 interest rate compounded monthly and make 500 deposits on a monthly basis after 15 years your savings account will have grown to 230629-- of which 115000 is the total of your beginning balance plus deposits and 115629 is the total interest earnings. Read about impersonation schemes crypto investment scams romance scams and more in our latest Investor Alert. With links to articles for more information.

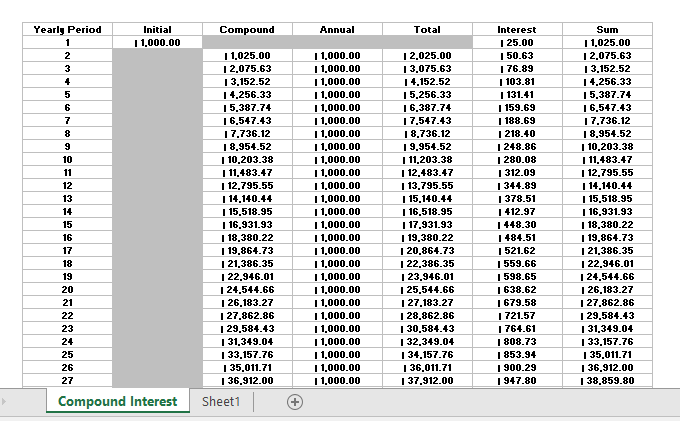

Compound annual growth rate calculator. At the end of three years simply add up each compound interest calculation to get your total future value. The ROI Calculator shows you the total gain on investment.

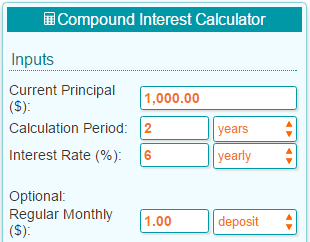

Compound Interest Calculator Savings Account Interest Calculator Consistent investing over a long period of time can be an effective strategy to accumulate wealth. Conversely the formula can be used to compute either gain from or cost of investment given a desired ROI. This is how often interest will be calculated on your deposit.

This means that your wealth grows by earning investment returns on your initial balance and then reinvesting the returns. Return to Top. The ROI Calculator consists of a formula box where you enter the initial amount invested the amount returned and the investment period.

With savings accounts and investments interest can be compounded at either the start or the end of the compounding period. Return rate For many investors this is what matters most. This calculator shows the return rate CAGR of an investment.

Bobs ROI on his sheep farming operation is 40. When you enter the three variables the CAGR calculator will give you the rate of return on the investment. Even small deposits to a.

When is my interest compounded. Use Forbes Advisors return on investment calculator to help plan your long-term in. The Investment Calculator can help determine one of many different variables concerning investments with a fixed rate of return.

The average stock market return is historically 10 annually though that rate is reduced by inflation. Say you have an investment account that increased from 30000 to 33000 over 30 months. This is the return on your investment.

You can use that number to see whether a particular investment is really. The return on investment ROI formula remains the same whether youre evaluating the performance of a single stock or considering the potential profit of a real estate investment. Some frequently asked questions about our compound interest calculator.

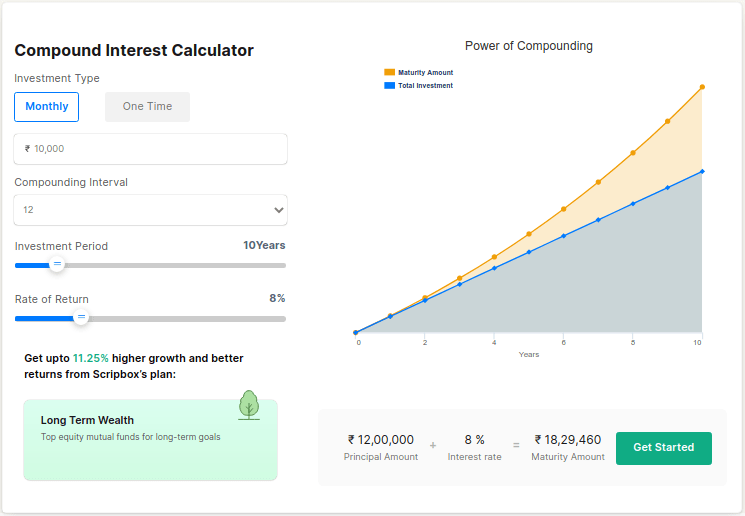

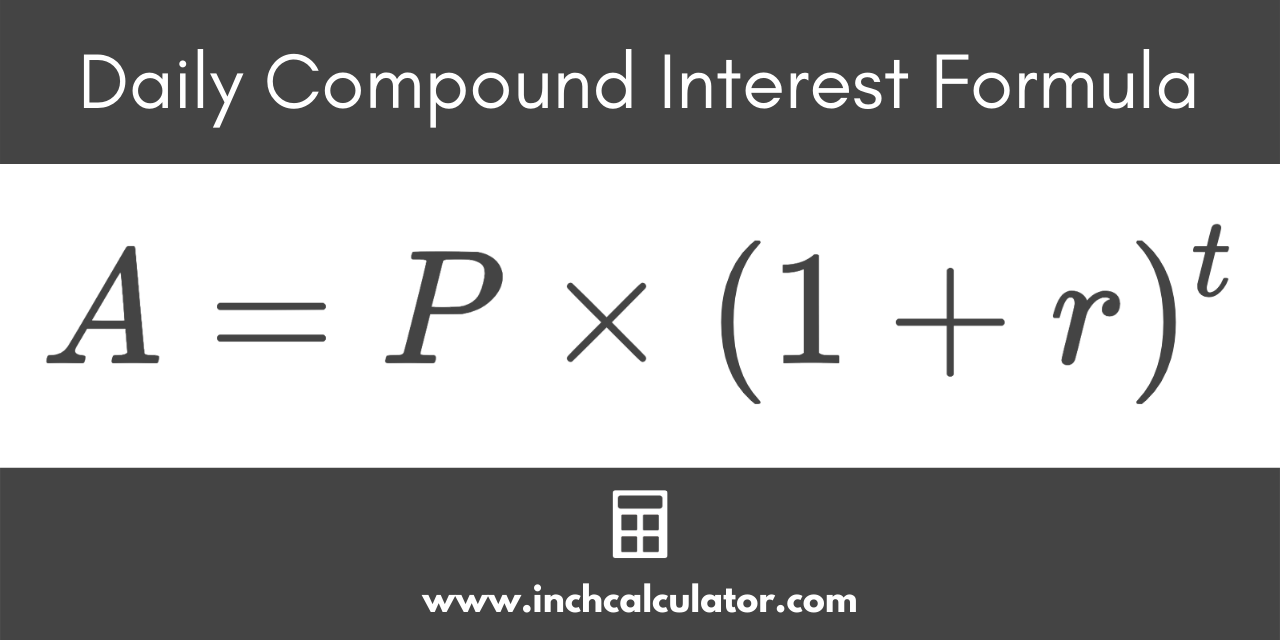

Determine how much your money can grow using the power of compound interest. The calculator above shows the compounding returns of an investment or the true cost of compounding debt. If your local bank offers a savings account with daily compounding 365 times per year what annual interest rate do you need to get to match the rate of return in your investment account.

Savings and investment calculator. To calculate your forecasted earnings on an investment enter your initial investment the amount you plan to add. On the surface it appears as a.

Your investment becomes 1100 after the first year then 1210 after 2nd year and so on. However when you have debt compound interest can work. CAGR makes it possible to compare profits from a particular investment with risk-free instruments.

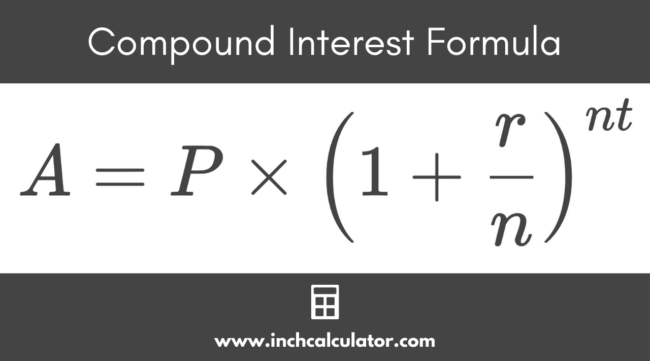

Therefore the fundamental characteristic of compound interest is that interest itself. It also shows you the absolute return on investment annualised return on investment and the CAGR or the compounded annual growth rate. Then select how frequently the interest compounds.

It also allows you to assess. Think of this as twelve different compound interest calculations one for each quarter that you deposit 135. The default value 20 equals the rate currently paid on five-year Guaranteed Investment Certificates1 You may change this to any rate you wish.

For any typical financial investment there are four crucial elements that make up the investment. Investment returns calculator There are several factors that can contribute to meeting your long-term investment goals. A compound interest calculator will help you determine how fast youll save money or spend money depending on your financial situation investments and debts.

How to Use the Compound Interest Calculator. If Bob wanted an ROI of 40 and knew his initial cost of investment was 50000 70000 is the gain he must make from the initial investment to realize his desired ROI. You can also sometimes estimate the return rate with The Rule of 72.

Compound interest works best as an investment tool - for example if you deposit 1000 in the bank and earn 5 per year with interest paid every month the interest earned each month is re-invested with your original 1000 and begins to. Which is better - an investment offering a 5 return compounded daily or a 6 return compounded annually. The following calculator allows you to quickly determine the answer to these sorts of questions.

See the CAGR of the SP 500 this investment return calculator CAGR Explained and How Finance Works for the rate of return formula. Generally compound interest is defined as interest that is earned not solely on the initial amount invested but also on any further interestIn other words compound interest is the interest on both the initial principal and the interest which has been accumulated on this principle so far. CAGR is one of the most accurate ways to calculate the return on an investment that rises and falls in value during the investment period.

You can also calculate the absolute return of the investment using the CAGR calculator. Compound interest is the engine that powers your investment returns over time. The compound interest calculator can tell you exactly how much money youll have in the future.

Disclaimer While the annualized rate of return is during the investment time period of 15 years the actual returns at the end of each year may not be linear. CAGR allows investors to compare investments with different time horizons. Investment returns are typically shown at an annual rate of return.

Use this calculator to gain a better understanding of how different inputs can impact the rate of return on your investments then connect with an Ameriprise advisor who can provide personalized advice for your long-term goals. Compound interest - meaning that the interest you earn each year is added to your principal so that the balance doesnt merely grow it grows at an increasing rate - is one of the most useful concepts in finance. It is the basis of everything from a personal savings plan to the long term growth of the stock market.

Compounding Interest Calculator Yearly Monthly Daily

Compound Interest Definition Formula How It S Calculated

Daily Compound Interest Calculator Inch Calculator

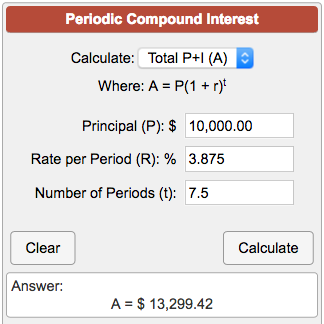

Periodic Compound Interest Calculator

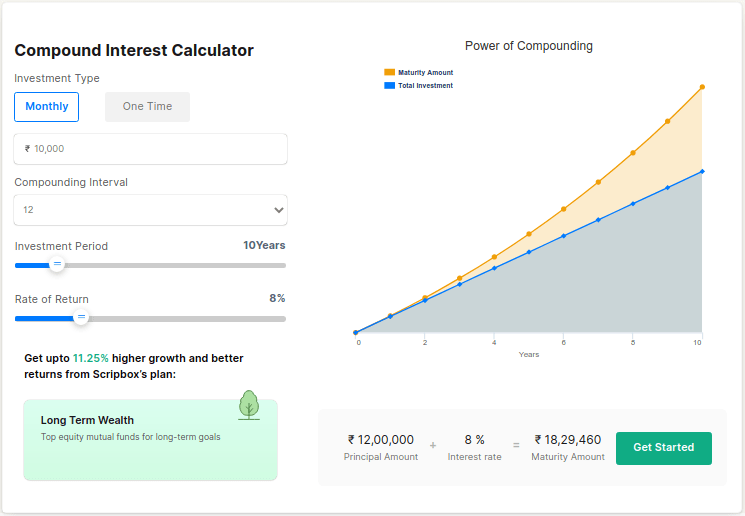

Power Of Compounding Investment Calculator Scripbox

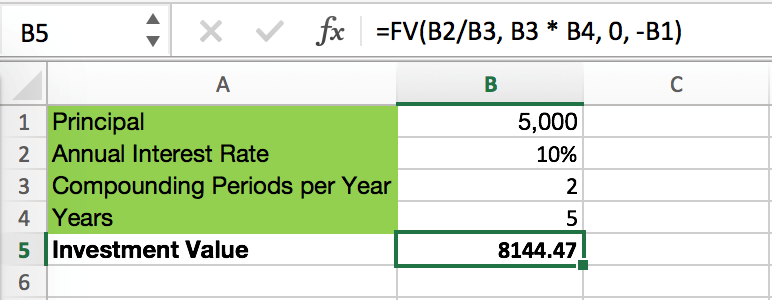

Compound Interest Calculator For Excel

Compound Interest Calculator Daily Monthly Quarterly Annual

Walletburst Compound Interest Calculator With Monthly Contributions

Compound Interest Calculator Daily Monthly Quarterly Annual

Compound Interest Formula In Excel And Google Sheets Automate Excel

Compound Interest Calculator Arrest Your Debt

/COMPOUNDINTERESTFINALJPEGcopy-f248781269194135aa6044e088de7af9.jpg)

What Is The Link Between Mutual Funds And Compound Interest

Compound Interest Calculator Daily Monthly Yearly

Daily Compound Interest Formula Calculator Excel Template

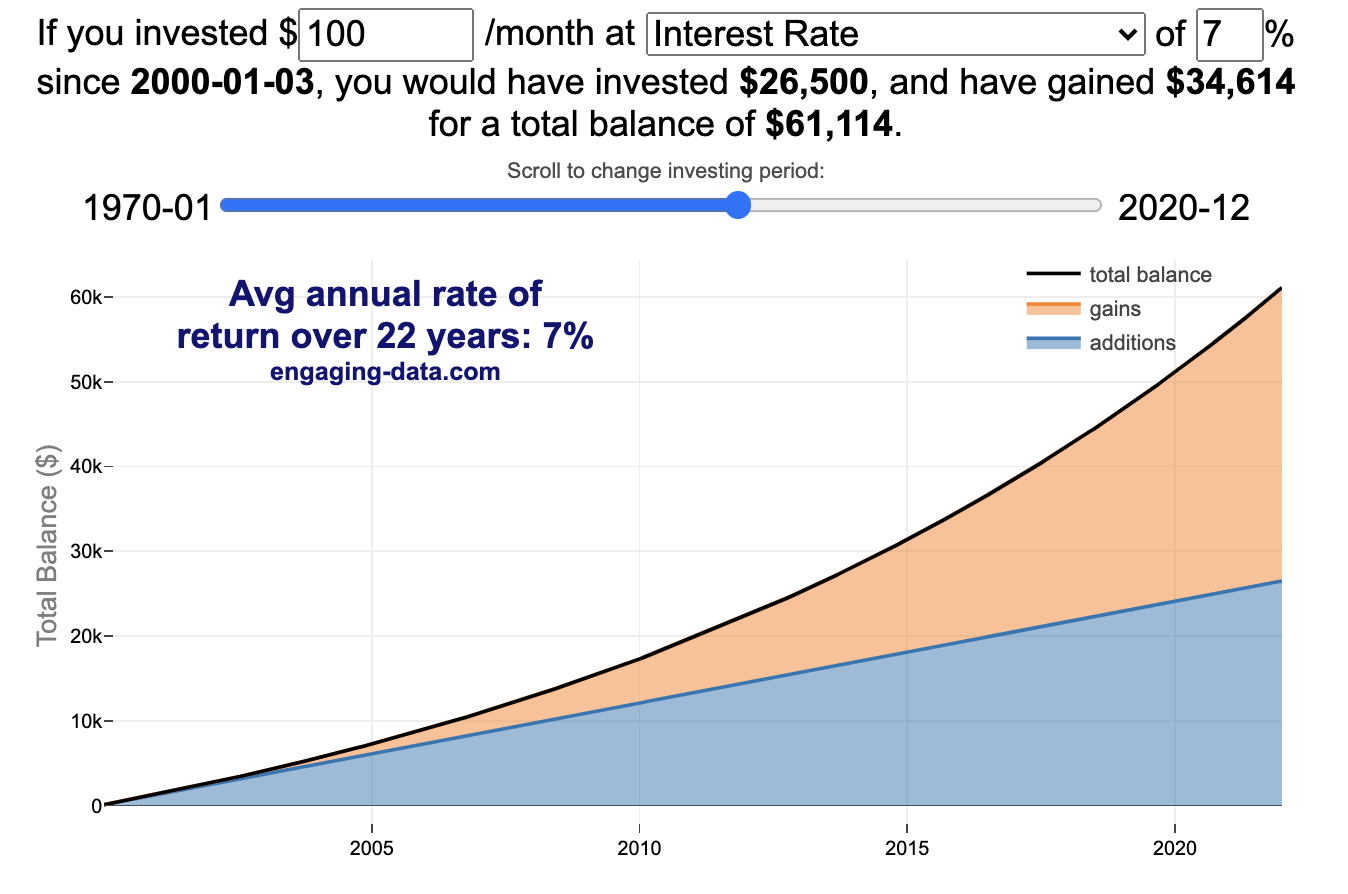

Compound Interest And Stock Returns Calculator Engaging Data

The Compound Interest Calculator Gemma Know Plan Act

Compound Interest Calculator Inch Calculator